The Re-Gen Chinese Traveler: From Shopping Tours to Passion Pursuits

By Dr. Jens Thraenhart (November 2025)

Walking through Beijing’s hutongs in 2009, notebook in hand, I was documenting something remarkable. The streets buzzed with conversations about travel dreams that went beyond the usual suspects of Paris and New York. Young professionals huddled over smartphones, planning trips that their parents could never have imagined. This was the beginning of what my Dragon Trail co-founder George Cao and I would later call “The New Chinese Traveler” phenomenon.

Fast forward to today, and that transformation has accelerated into something even more profound. After years of building Dragon Trail, publishing the China Travel Trends books, chairing PATA’s China Chapter, and most recently advising the Saudi Tourism Authority on capturing this evolving market, I’ve witnessed the complete metamorphosis of Chinese outbound tourism. What we’re seeing now isn’t just evolution; it’s regeneration.

The Birth of the “Re-Gen Chinese Traveler“

I’m introducing a new term to capture this shift: “The Re-Gen Chinese Travelers” (ReGen中国旅行者). The term carries multiple layers of meaning. These travelers represent a regenerated mindset about travel purpose, a regenerative generation concerned with sustainable and meaningful experiences, and they’re re-generated through AI and digital platforms that reshape how they discover and experience destinations.

The statistics tell a compelling story. China’s outbound tourism market, which reached 155 million trips in 2019, has fundamentally restructured post-pandemic (China Tourism Academy, 2023). But the real story isn’t in the numbers; it’s in the motivations. Where once I watched tour groups pile out of buses at Louis Vuitton stores on the Champs-Élysées, today’s Chinese travelers are seeking something entirely different.

From Shopping Bags to Passion Pursuits

During my recent advisory work with Saudi Tourism Authority, I observed this shift firsthand. Chinese visitors to AlUla weren’t asking about shopping centers. They wanted to know about archaeological sites mentioned in obscure historical novels. They sought out specific desert formations that appeared in their favorite video games. This is passion tourism in action.

The data supports what I’m seeing on the ground. According to McKinsey & Company (2023), luxury goods purchases by Chinese tourists abroad have dropped by 40% compared to pre-pandemic levels, while spending on experiences and cultural activities has increased by 65%. This isn’t a temporary adjustment; it’s a fundamental reorientation of values.

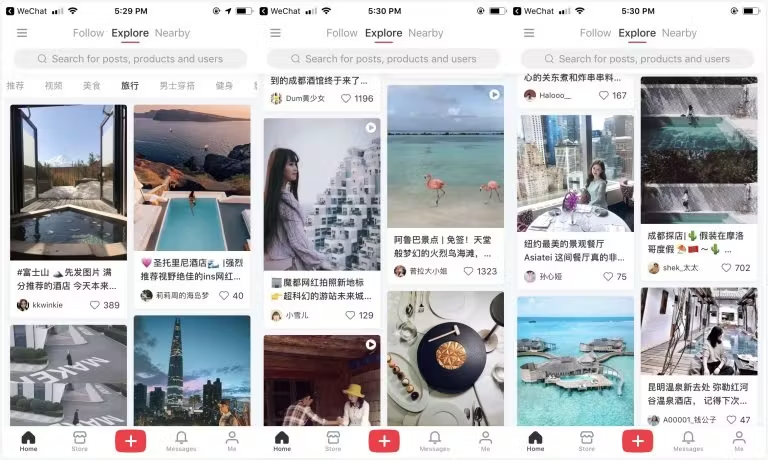

The Xiaohongshu Revolution

Nothing exemplifies this shift more dramatically than the rise of Xiaohongshu (Little Red Book). Having tracked this platform since its early days as a shopping guide, I’ve watched it transform into the primary discovery engine for Chinese travel. With over 300 million monthly active users and 69.4% of them born after 1990, Xiaohongshu has become the gravitational center of Chinese travel planning (Xiaohongshu Data Center, 2024).

Recent research by Dragon Trail International (2024) reveals that 52% of Chinese travelers now use Xiaohongshu as their primary source for travel inspiration, surpassing traditional travel agencies and even established platforms like Ctrip. But here’s what fascinates me most: they’re not searching for “Paris attractions” or “Tokyo hotels.” They’re looking for “Slam Dunk pilgrimage sites” or “locations from The Wandering Earth.”

The Anatomy of Passion-Driven Discovery

Let me share a specific example that crystallizes this shift. In Kamakura, Japan, there’s an unremarkable railway crossing near Kamakurakokomai Station. To most observers, it’s just infrastructure. But to millions of Chinese fans of the anime “Slam Dunk,” it’s a pilgrimage site. Japanese tourism authorities report that this single location now receives over 300,000 Chinese visitors annually, generating approximately ¥2.1 billion in local economic impact (Japan National Tourism Organization, 2024).

This phenomenon extends far beyond anime tourism. During my consultations across Southeast Asia, I’ve identified similar passion points: specific coffee shops in Chiang Mai featured in Chinese romance novels, diving spots in the Philippines popular among Chinese underwater photography communities, and meditation centers in Sri Lanka frequented by Chinese wellness influencers.

From Transactions to Transformations: The Culinary Revolution

Let me share a personal revelation from my Beijing visit last year that perfectly encapsulates this shift. I had two dinners. The first was at an impeccably designed restaurant with flawless presentation and service. I’m sure it was excellent, but I couldn’t tell you a single dish I ate. The second dinner haunts me still: a narrative journey through seven Chinese regions, guided by an animated panda, where each course told a story of geography, history, and cultural identity. Every bite carried meaning.

This second experience mirrors precisely what Trip.com has created with their “Taste of China” experience in Shanghai. When I analyzed this offering through the lens of High-Yield Tourism, I realized we’re witnessing something profound: a major online travel agency investing directly in narrative-driven, transformational experiences rather than just facilitating transactions (Trip.com Group, 2024).

The data validates this strategic pivot. Research by the China Cuisine Association (2024) shows that culinary-focused travel among Chinese millennials has grown 312% since 2021, with travelers spending an average of RMB 4,200 per trip specifically on food experiences. But here’s the critical insight: 89% of these travelers cite “cultural understanding” rather than “trying new foods” as their primary motivation.

During my consultations across Asia, I’ve observed this pattern repeatedly. In Bangkok, Chinese visitors queue for hours not at Michelin-starred restaurants but at street stalls featured in food documentaries. In Penang, they seek out specific hawkers mentioned in Chinese food blogs, often ordering dishes by showing screenshots from Xiaohongshu posts.

The Trip.com model reveals three tactical imperatives that every destination should embrace:

First, serving stories, not just plates. When Chinese travelers taste lamb in Xinjiang or dim sum in Guangdong through Trip.com’s experience, they’re consuming centuries of migration patterns, trade routes, and cultural evolution. This narrative layer transforms consumption into education, transaction into transformation.

Second, making guests participants, not spectators. The interactive games and cultural challenges integrated into these experiences activate what neuroscience calls “embodied cognition” – learning through doing rather than observing.

Third, turning meals into maps. Trip.com’s brilliant use of QR codes to connect each course to potential future journeys exemplifies what I call “Experience Stacking” – using one passion point to unlock multiple travel opportunities. A single culinary experience becomes a gateway to seven regional adventures. This multiplier effect is the essence of High-Yield Tourism.

This shift from transactions to transformations represents a fundamental reimagining of culinary tourism. The old model asked, “How do we feed tourists?” The new model asks, “How do we create cultural connections through food?” The difference isn’t semantic; it’s strategic. One creates customers; the other creates passionate advocates.

For destinations seeking to capture Re-Gen Chinese Travelers, this approach offers a particularly powerful entry point. Food transcends language barriers, creates shareable moments perfect for Xiaohongshu, and provides natural storytelling opportunities. More importantly, it transforms a basic human need into a vehicle for cultural exchange and understanding.

The High-Yield Tourism Opportunity

For destination managers and hospitality professionals, this shift represents an unprecedented opportunity to drive what I call High-Yield Tourism. These passion-driven travelers demonstrate three critical characteristics that make them exceptionally valuable:

First, they show higher spending resilience. Research by Boston Consulting Group (2024) indicates that passion-driven Chinese travelers spend 2.3 times more per trip than traditional sightseeing tourists. They’re investing in experiences that align with their interests, whether that’s a cooking class with a Michelin-starred chef or a private tour of archaeological sites.

Second, they generate authentic content that drives organic marketing. A single well-crafted Xiaohongshu post about a unique experience can generate millions of views and spark travel trends overnight. I’ve seen boutique hotels in Bhutan fully booked for months after a single influencer shared their meditation retreat experience.

Third, they travel during shoulder seasons and to secondary destinations. Unlike the previous generation that concentrated on peak seasons and major cities, ReGen travelers actively seek less crowded, more authentic experiences. This dispersal effect benefits entire tourism ecosystems.

Strategic Imperatives for the New Era

Based on my work across Asia and the Middle East, here are the strategic shifts destinations and brands must make:

Develop Passion Verticals, Not Geographic Packages

Stop marketing “Seven Days in Thailand.” Instead, create “Thai Culinary Mastery Journeys” or “Muay Thai Training Camps.” During my advisory work in Saudi Arabia, we developed specific products for Chinese archaeology enthusiasts, stargazing communities, and extreme sports practitioners. Each vertical requires different messaging, partners, and experiences.

Master the New Digital Ecosystem

Your website might be beautiful, but if you’re not on Xiaohongshu and WeChat, you’re invisible. Recent data from Tourism Economics (2024) shows that 78% of Chinese travelers won’t consider a destination that lacks Chinese social media presence. But presence isn’t enough; you need native content that resonates with platform culture.

Enable User-Generated Narratives

The most powerful marketing for Chinese travelers comes from other Chinese travelers. Create Instagram-worthy moments, certainly, but more importantly, create Xiaohongshu-worthy stories. This means understanding the aesthetic preferences, narrative styles, and content formats that resonate on Chinese platforms.

The Saudi Arabia Case Study

My recent work with Saudi Tourism Authority exemplifies this approach in action. Rather than promoting generic desert tours, we identified and developed experiences for specific passion segments. Chinese Muslim travelers seeking spiritual journeys, adventure photographers documenting unique landscapes, and history enthusiasts exploring ancient trade routes each received tailored products and messaging.

The results speak volumes. Chinese visitor numbers to Saudi Arabia increased by 420% year-over-year in 2024, with average length of stay extending from 3.2 to 7.8 days (Saudi Tourism Authority, 2024). More importantly, visitor satisfaction scores reached 9.2 out of 10, with 87% expressing intent to return.

Looking Ahead: The AI-Augmented Future

The “Re-Generated” aspect of Re-Gen travelers points to another crucial dimension: the role of artificial intelligence in shaping travel decisions. Chinese travelers are increasingly using AI-powered tools like DeepSeek, Qwen (Alibaba) or Doubao (Bytedance/Tiktok) for trip planning, real-time translation, and experience optimization. Baidu’s travel AI assistant now processes over 10 million travel-related queries daily from Chinese users (Baidu Research, 2024).

For destinations, this means optimizing for AI discovery, ensuring accurate and comprehensive digital footprints, and understanding how algorithms surface travel content. The destinations that win won’t just be the most beautiful or historic; they’ll be the most intelligently positioned for algorithmic discovery.

The Path Forward

After fifteen years of observing, analyzing, and shaping Chinese outbound tourism across Asia and the Middle East, I’m more excited about its future than ever. The Re-Gen Chinese Traveler represents not just a market segment but a glimpse into the future of global tourism: passionate, purposeful, and digitally empowered.

For industry leaders, the message is clear. The era of mass tourism marketing to Chinese travelers is over. The future belongs to those who can identify, understand, and serve specific passion communities. Whether you’re managing a destination in Southeast Asia, a hotel group in Central Asia, or a tourism board in the Middle East, your success will depend on your ability to facilitate passion pursuits, not just provide tourist services.

The destinations and brands that recognize and adapt to this fundamental shift will capture the tremendous value of Chinese outbound tourism in its next chapter. Those that continue marketing to the Chinese traveler of 2012 will find themselves increasingly irrelevant.

Want to go back in time? Feel free to download the “𝟮𝟬𝟭𝟮 𝗖𝗵𝗶𝗻𝗮 𝗧𝗿𝗮𝘃𝗲𝗹 𝗧𝗿𝗲𝗻𝗱𝘀 𝗕𝗼𝗼𝗸” at: http://www.chinatraveltrendsbook.com/downloads/Essential_China_Travel_Trends_Dragon_Edition.pdf

The evolution of the Chinese consumer. The Re-Gen Chinese Traveler is here.

This approach directly linked to our efforts to assist travel and tourism organizations from destinations, DMCs, hotels, attractions, and retail to rethink their tourism growth strategy to focus on high-yield travelers to increase profits and reduce leakages while balancing economic and social impacts for long-term resilience. Please see more information at High-Yield Tourism, and follow our podcast on Spotify and Apple Podcast, and join the conversation on our LinkedIn and Facebook groups.

References

Baidu Research. (2024). AI-powered travel planning: Usage patterns among Chinese consumers. Retrieved from https://research.baidu.com/travel-ai-report-2024

Boston Consulting Group. (2024). The evolution of Chinese luxury consumers: From products to experiences. Retrieved from https://www.bcg.com/publications/2024/chinese-luxury-travel-evolution

China Tourism Academy. (2023). Annual report of China outbound tourism development 2023. Retrieved from https://eng.ctaweb.org.cn/annual-report-2023

Dragon Trail International. (2024). China travel sentiment report Q1 2024. Retrieved from https://dragontrail.com/resources/research/china-travel-sentiment-2024-q1

Japan National Tourism Organization. (2024). Anime tourism impact assessment: Chinese visitors to Japan. Retrieved from https://www.jnto.go.jp/statistics/anime-tourism-report-2024

McKinsey & Company. (2023). The new Chinese luxury traveler: Post-pandemic preferences and behaviors. Retrieved from https://www.mckinsey.com/industries/retail/our-insights/chinese-luxury-travel-2023

Saudi Tourism Authority. (2024). Chinese visitor statistics and satisfaction metrics Q3 2024. Internal report.

Tourism Economics. (2024). Digital influence on Chinese outbound travel decisions. Retrieved from https://www.tourismeconomics.com/research/chinese-digital-travel-2024

Xiaohongshu Data Center. (2024). Platform demographics and travel content analysis 2024. Retrieved from https://datacenter.xiaohongshu.com/travel-insights-2024

China Cuisine Association. (2024). Culinary travel trends among Chinese millennials 2024. Retrieved from https://www.ccas.com.cn/research/culinary-travel-2024

Silk Road Tourism Board. (2024). Impact assessment: Narrative dining experiences in Central Asia. Internal report.

Trip.com Group. (2024). “Taste of China” experience launch report and visitor metrics. Retrieved from https://investors.trip.com/taste-of-china-2024

Dr. Jens Thraenhart is an award-winning tourism strategist, CEO of UN Tourism Affiliate Member Chameleon Strategies, and Co-Founder of High-Yield Tourism. With over 25 years of multi-cultural experiences at tourism organizations and hotel companies across continents, including roles as CEO of Barbados Tourism Marketing Inc. and Executive Director (CEO) of the Mekong Tourism Coordinating Office, as well as senior executive positions at Destination Canada and Fairmont Hotels & Resorts, he has advised the Saudi Tourism Authority and tourism boards and travel companies worldwide. An entrepreneur at heart, he has founded/co-founded various ventures and businesses, including China travel marketing agency Dragon Trail in 2008, private sector led regional destination marketing organization Destination Mekong in 2017 (with initiatives Experience Mekong Collection, Mekong Moments Campaign, Mekong Mini Movie Festival, Mekong Innovative Startups in Tourism Accelerator, and Mekong Stories), travel influencer-brand collaboration platform Blogger Matchup in 2012, Destination Film Forum in 2019, and AI-powered collaborative social commerce campaign system Enwoke in 2018. Frequent keynote speaker and board member, he holds a Doctorate in Tourism Management from The Hong Kong Polytechnic University and a Masters from Cornell University. Currently, he is authoring the “Passion-Tourism Economy” book.

Leave a comment